Gas stations: a commercial potential still underexploited

- Amaury Marescaux

- Aug 20, 2025

- 2 min read

INSIGHT OF THE WEEK - On the highway as in the city, the gas station remains primarily a fueling point. But changing usage patterns, driven by the rise of electric vehicles and expectations for fast, high-quality food, are opening up a field of opportunities that have yet to be fully exploited.

While electric car registrations are growing (23% market share according to Febiac), they still only represent 6.9% of the fleet. These drivers visit a station less than once a month, preferring to charge at home or at the office. When they do, however, it's for longer: 35 minutes on average, compared to five for fossil fuel users.

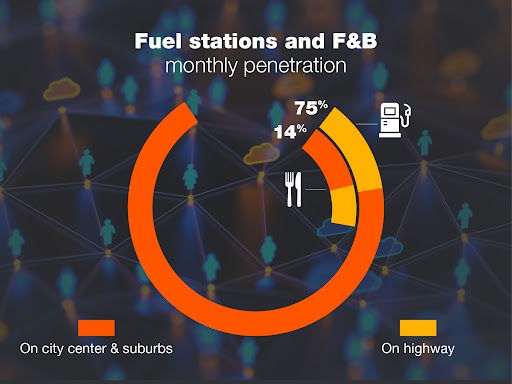

The latter visit petrol stations more (75% at least once a month), but mainly those located near their homes (85%) rather than on motorways, where food consumption is the highest.

Marginal food consumption

Less than 14% of Belgians buy food or drinks at gas stations each month, compared to more than one in two at a restaurant. And when they do consume, twice as many do so on the motorway (64%) as at a local gas station (36%), mainly for reasons of convenience and speed.

The obstacles remain clearly identified: prices deemed too high, a limited offering, little variety, and rarely perceived as healthy. The typical shopping basket consists mainly of drinks (60%), sandwiches (55%), snacks (51%), and coffee (41%), more of which are incidental purchases than genuine gourmet breaks.

To a “destination” gas station

The model is evolving, however, and many initiatives are being taken to make the service station a true destination. On motorways, for example, the offerings are becoming more diverse: fast food outlets (Burger King, McDonald's, KFC), full-service restaurants, gaming or work spaces, barista-style coffee bars, notably Starbucks. The idea is to allow consumers to spend more quality time (and more profitably for the operator) at service stations.

In urban and suburban areas, some stations are repositioning themselves as alternatives to convenience stores, focusing in particular on fresh, varied, and convenient products. Esso has partnered with Louis Delhaize to manage its shops. Q8 has done the same for its "Shop&Go" stores, which have been entrusted to Delhaize.

For operators, the key could be there: transforming the refueling point into a true daily destination, capable of attracting customers looking for speed, convenience... and quality.