Coca-Cola giant reportedly ready to sell Costa Coffee at half price

- François Remy

- Aug 25, 2025

- 3 min read

The UK's largest coffee shop chain, Costa Coffee, could soon be changing hands: Coca-Cola has reportedly already met with potential buyers and is even considering selling at a loss.

“Hot drinks are one of the few segments in the entire drinks market where Coca-Cola doesn’t have a global brand. Costa gives us access to this market through strong expertise in coffee,” said James Quincey, CEO of the soft drinks giant, when he unveiled the acquisition for some £3.9 billion in 2018 (equivalent to €4.5 billion today).

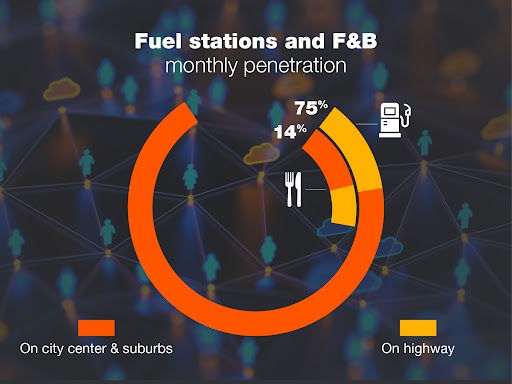

The London-based company, founded in 1971 and a major competitor to Starbucks, had a leading brand with vending machines, home formats, a state-of-the-art roasting plant, nearly 4,000 points of sale worldwide (including China), and highly qualified baristas in strategic locations such as gas stations, cinemas, and train stations/airports. In Belgium, Costa Coffee had also opened its first café in the main hall of Liège-Guillemins.

But despite the move to Coca-Cola, the company, already renowned for its coffee, has not performed as expected. It has suffered from rising costs, particularly the price of coffee beans, as well as increased competition in city centers. In France, its establishment at Liège train station was unable to withstand a new call for tenders from SNCB, which preferred the American brand to the mermaid. Add to this a phenomenon of "flight to quality," with coffee consumers readily turning to premium products.

Costa's hypothetical performance did not materialize

More generally, Costa's financial results have tended to weaken, with turnover falling below its pre-acquisition level and the financial year even ending in the red in 2023. In other words, this attempt to enter the coffee market, the fourth for Coca-Cola (after the Georgia episode, Keurig and, earlier, Duncan Coffee) was still not the right one.

"Our investment in Costa is not where we wanted it to be from the perspective of our investment hypothesis," acknowledged CEO James Quincey during the ritual interview with stock market analysts on the sidelines of the periodic results last June. Before explaining why this company, which remains "a good business," has not achieved the various expected growth areas. "We had hoped to accelerate much more quickly, such as ready-to-drink coffee, Express machines at home. So the business remains more focused on stores. Where we have worked on price accessibility and we have done a good job of refreshing them and accelerating the speed of service."

For Coca-Cola, coffee remains a vast, fragmented, and growing category in the beverage industry. A clearly attractive segment, especially since the multinational could find ways to participate more deeply in this category through its bottling system. But since the Costa hypothesis did not materialize, management is looking for "new avenues of growth in coffee."

A possible resale at half price

The Coca-Cola Company is now reportedly working with investment bankers to assess its options for Costa Coffee. This financial assessment could indeed lead to a sale, London's Sky News revealed, with losses of several billion even being accepted. City analysts have indicated that a power cut could be possible for as little as £2 billion, almost half the original purchase price.

Coca-Cola has reportedly already met with a handful of potential buyers, including private equity firms. Preliminary offers are expected in early fall. However, according to sources familiar with the matter, who spoke to Sky News and Reuters, the current owner may ultimately decide not to proceed with the sale.

"The proceeds from the sale would not be material to the Atlanta-based company, whose market capitalisation at Friday's closing price was $304.2 billion (£224.9 billion)," Sky News noted.

However, despite its poor performance, Costa Coffee has paid out more than £250 million in dividends to its owner since the acquisition.